4.5: Market Equilibrium

- Page ID

- 250494

\( \newcommand{\vecs}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vecd}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash {#1}}} \)

\( \newcommand{\id}{\mathrm{id}}\) \( \newcommand{\Span}{\mathrm{span}}\)

( \newcommand{\kernel}{\mathrm{null}\,}\) \( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\) \( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\) \( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\inner}[2]{\langle #1, #2 \rangle}\)

\( \newcommand{\Span}{\mathrm{span}}\)

\( \newcommand{\id}{\mathrm{id}}\)

\( \newcommand{\Span}{\mathrm{span}}\)

\( \newcommand{\kernel}{\mathrm{null}\,}\)

\( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\)

\( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\)

\( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\inner}[2]{\langle #1, #2 \rangle}\)

\( \newcommand{\Span}{\mathrm{span}}\) \( \newcommand{\AA}{\unicode[.8,0]{x212B}}\)

\( \newcommand{\vectorA}[1]{\vec{#1}} % arrow\)

\( \newcommand{\vectorAt}[1]{\vec{\text{#1}}} % arrow\)

\( \newcommand{\vectorB}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vectorC}[1]{\textbf{#1}} \)

\( \newcommand{\vectorD}[1]{\overrightarrow{#1}} \)

\( \newcommand{\vectorDt}[1]{\overrightarrow{\text{#1}}} \)

\( \newcommand{\vectE}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash{\mathbf {#1}}}} \)

\( \newcommand{\vecs}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vecd}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash {#1}}} \)

\(\newcommand{\avec}{\mathbf a}\) \(\newcommand{\bvec}{\mathbf b}\) \(\newcommand{\cvec}{\mathbf c}\) \(\newcommand{\dvec}{\mathbf d}\) \(\newcommand{\dtil}{\widetilde{\mathbf d}}\) \(\newcommand{\evec}{\mathbf e}\) \(\newcommand{\fvec}{\mathbf f}\) \(\newcommand{\nvec}{\mathbf n}\) \(\newcommand{\pvec}{\mathbf p}\) \(\newcommand{\qvec}{\mathbf q}\) \(\newcommand{\svec}{\mathbf s}\) \(\newcommand{\tvec}{\mathbf t}\) \(\newcommand{\uvec}{\mathbf u}\) \(\newcommand{\vvec}{\mathbf v}\) \(\newcommand{\wvec}{\mathbf w}\) \(\newcommand{\xvec}{\mathbf x}\) \(\newcommand{\yvec}{\mathbf y}\) \(\newcommand{\zvec}{\mathbf z}\) \(\newcommand{\rvec}{\mathbf r}\) \(\newcommand{\mvec}{\mathbf m}\) \(\newcommand{\zerovec}{\mathbf 0}\) \(\newcommand{\onevec}{\mathbf 1}\) \(\newcommand{\real}{\mathbb R}\) \(\newcommand{\twovec}[2]{\left[\begin{array}{r}#1 \\ #2 \end{array}\right]}\) \(\newcommand{\ctwovec}[2]{\left[\begin{array}{c}#1 \\ #2 \end{array}\right]}\) \(\newcommand{\threevec}[3]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \end{array}\right]}\) \(\newcommand{\cthreevec}[3]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \end{array}\right]}\) \(\newcommand{\fourvec}[4]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \\ #4 \end{array}\right]}\) \(\newcommand{\cfourvec}[4]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \\ #4 \end{array}\right]}\) \(\newcommand{\fivevec}[5]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \\ #4 \\ #5 \\ \end{array}\right]}\) \(\newcommand{\cfivevec}[5]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \\ #4 \\ #5 \\ \end{array}\right]}\) \(\newcommand{\mattwo}[4]{\left[\begin{array}{rr}#1 \amp #2 \\ #3 \amp #4 \\ \end{array}\right]}\) \(\newcommand{\laspan}[1]{\text{Span}\{#1\}}\) \(\newcommand{\bcal}{\cal B}\) \(\newcommand{\ccal}{\cal C}\) \(\newcommand{\scal}{\cal S}\) \(\newcommand{\wcal}{\cal W}\) \(\newcommand{\ecal}{\cal E}\) \(\newcommand{\coords}[2]{\left\{#1\right\}_{#2}}\) \(\newcommand{\gray}[1]{\color{gray}{#1}}\) \(\newcommand{\lgray}[1]{\color{lightgray}{#1}}\) \(\newcommand{\rank}{\operatorname{rank}}\) \(\newcommand{\row}{\text{Row}}\) \(\newcommand{\col}{\text{Col}}\) \(\renewcommand{\row}{\text{Row}}\) \(\newcommand{\nul}{\text{Nul}}\) \(\newcommand{\var}{\text{Var}}\) \(\newcommand{\corr}{\text{corr}}\) \(\newcommand{\len}[1]{\left|#1\right|}\) \(\newcommand{\bbar}{\overline{\bvec}}\) \(\newcommand{\bhat}{\widehat{\bvec}}\) \(\newcommand{\bperp}{\bvec^\perp}\) \(\newcommand{\xhat}{\widehat{\xvec}}\) \(\newcommand{\vhat}{\widehat{\vvec}}\) \(\newcommand{\uhat}{\widehat{\uvec}}\) \(\newcommand{\what}{\widehat{\wvec}}\) \(\newcommand{\Sighat}{\widehat{\Sigma}}\) \(\newcommand{\lt}{<}\) \(\newcommand{\gt}{>}\) \(\newcommand{\amp}{&}\) \(\definecolor{fillinmathshade}{gray}{0.9}\)Supply and Demand Together: Market Equilibrium

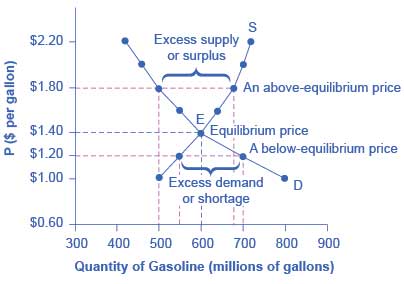

The intersection of the supply and demand curves determines the market equilibrium . At the equilibrium price, the quantity demanded equals the quantity supplied. Because the graphs for demand and supply curves both have price on the vertical axis and quantity on the horizontal axis, the demand curve and supply curve for a particular good or service can appear on the same graph. Together, demand and supply determine the price and the quantity that will be bought and sold in a market.

We can use either a tabular approach or a graphical approach to find the equilibrium in a market.

Table 2.3. Tabular Approach for the Gasoline Market

| Price (per gallon) | Quantity demanded (millions of gallons) | Quantity supplied (millions of gallons) |

|---|---|---|

| $1.00 | 800 | 500 |

| $1.20 | 700 | 550 |

| $1.40 | 600 | 600 |

| $1.60 | 550 | 640 |

| $1.80 | 500 | 680 |

| $2.00 | 460 | 700 |

The demand curve (D) and the supply curve (S) intersect at the equilibrium point E, with a price of $1.40 and a quantity of 600. The equilibrium is the only price where quantity demanded is equal to quantity supplied. At a price above equilibrium like $1.80, quantity supplied exceeds the quantity demanded, so there is excess supply. At a price below equilibrium such as $1.20, quantity demanded exceeds quantity supplied, so there is excess demand. (4)

Equilibrium

When two lines on a diagram cross, this intersection usually means something. The point where the supply curve and the demand curve cross is called the equilibrium . The equilibrium price is the only price where the plans of consumers and the plans of producers agree — that is, where the amount of the product consumers want to buy (quantity demanded) is equal to the amount producers want to sell (quantity supplied). This common quantity is called the equilibrium quantity . At any other price, the quantity demanded does not equal the quantity supplied, so the market is not in equilibrium at that price.

The word “equilibrium” means “balance.” If a market is at its equilibrium price and quantity, then it has no reason to move away from that point. However, if a market is not at equilibrium, then economic pressures arise to move the market toward the equilibrium price and the equilibrium quantity. (4)

Surplus and Shortage

Imagine, for example, that the price was above the equilibrium price. At this higher price, the quantity demanded is smaller than the quantity supplied. The difference represents a surplus (an excess supply). With a surplus, the gasoline will accumulate at the gas stations that sell. This accumulation puts pressure on gasoline gas stations (sellers). If a surplus remains unsold, those firms involved in making and selling gasoline are not receiving enough cash to pay their workers and to cover their expenses.

In this situation, some producers and sellers will want to cut prices, because it is better to sell at a lower price than not to sell at all. Once some sellers start cutting prices, others will follow to avoid losing sales. These price reductions in turn will stimulate a higher quantity demanded. So, if the price is above the equilibrium level, incentives built into the structure of demand and supply will create pressures for the price to fall toward the equilibrium.

Now suppose that the price is below its equilibrium level. At this lower price, the quantity demanded is greater than the quantity supplied. The difference represents a shortage (on the supply side). In this situation, consumers mob gas stations, only to find many of them are running short of gasoline. Gas stations recognize that they have an opportunity to make higher profits by selling what gasoline they have at a higher price. As a result, the price rises toward the equilibrium level. (4)

Changes in Market Equilibrium

The 3-Step Approach to Changes in Equilibrium

To analyze how any event influences a market, we use the supply and demand model to examine how the event affects the equilibrium price and the equilibrium quantity.

To do this we follow these three steps :

Step 1

We decide whether the event affects/shifts the supply curve or the demand curve, or both. We use the following theoretical shifters (scroll down the list until you find a match):

Demand Shifters:

- Prices of related goods: substitutes and complements

- Expectations

- Society’s income

- Number of buyers

- Preferences (taste & attractiveness)

Supply Shifters:

- Prices of related goods (substitutes or complements in production)

- Prices of resources and other inputs

- Expectations in general

- Number of sellers

- Productivity (Technology improvements)

Next, we combine all the effects on supply/demand from each of the given events to find the net effect on each curve. If we cannot determine the net effect (i.e., one event causes demand to increase, and the other event causes demand to decrease, but we don’t know which effect is greater) we cannot continue to step 2. (1)

Step 2

We decide in which direction each curve shifts ( increase = shift to the right ; decrease = shift to the left for both supply and demand curves). (1)

Step 3

We draw one graph (short-cut approach) or three graphs (comprehensive approach) every time we have a set of events that shifts both supply and demand curves (a double shift scenario). We find the original equilibrium and the new equilibrium points, and by comparing them we finally conclude on what happens to the equilibrium price and equilibrium quantity after the given events take place.

You need to be able to find such results from the graph(s) you build. Thus, there is no need to memorize any of the results. The model you build will produce those results, which are the theoretical predictions about the equilibrium price and the equilibrium quantity in the targeted market. Once all the relevant information is included in the graph, you should be able to find the model’s predictions, and summarize them under the conclusions section. (1)

Always remember:

In a double shift scenario, with no quantitative information on which shift is bigger, the conclusion on one of the equilibrium variables will always be: undetermined or ambiguous , which means that one of the equilibrium variables could go up, go down, or stay the same. Without additional information on the relative size of shifts of each curve, the only general prediction you can make on that particular equilibrium variable (which could be either the equilibrium price or the equilibrium quantity) is: undetermined or ambiguous. On the other hand, if additional quantitative information is available, allowing you to draw the new curves based on the exact sizes of shifts provided you could conclude with certainty what happens to the equilibrium price and the equilibrium quantity.

To aid your understanding regarding Step 3 of the approach, check out these five short videos:

Click on the link below to view the video playlist. Be sure to watch all five videos in the playlist.

- Text Content and YouTube Videos. Authored by: Florida State College at Jacksonville. License: CC BY: Attribution

- Principles of Macroeconomics. Authored by: OpenStax. Located at: http://cnx.org/contents/4061c832-098e-4b3c-a1d9-7eb593a2cb31@11.11. License: CC BY: Attribution