7.7: South Carolina Energy

- Page ID

- 95694

\( \newcommand{\vecs}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vecd}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash {#1}}} \)

\( \newcommand{\id}{\mathrm{id}}\) \( \newcommand{\Span}{\mathrm{span}}\)

( \newcommand{\kernel}{\mathrm{null}\,}\) \( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\) \( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\) \( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\inner}[2]{\langle #1, #2 \rangle}\)

\( \newcommand{\Span}{\mathrm{span}}\)

\( \newcommand{\id}{\mathrm{id}}\)

\( \newcommand{\Span}{\mathrm{span}}\)

\( \newcommand{\kernel}{\mathrm{null}\,}\)

\( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\)

\( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\)

\( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\inner}[2]{\langle #1, #2 \rangle}\)

\( \newcommand{\Span}{\mathrm{span}}\) \( \newcommand{\AA}{\unicode[.8,0]{x212B}}\)

\( \newcommand{\vectorA}[1]{\vec{#1}} % arrow\)

\( \newcommand{\vectorAt}[1]{\vec{\text{#1}}} % arrow\)

\( \newcommand{\vectorB}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vectorC}[1]{\textbf{#1}} \)

\( \newcommand{\vectorD}[1]{\overrightarrow{#1}} \)

\( \newcommand{\vectorDt}[1]{\overrightarrow{\text{#1}}} \)

\( \newcommand{\vectE}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash{\mathbf {#1}}}} \)

\( \newcommand{\vecs}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vecd}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash {#1}}} \)

\(\newcommand{\avec}{\mathbf a}\) \(\newcommand{\bvec}{\mathbf b}\) \(\newcommand{\cvec}{\mathbf c}\) \(\newcommand{\dvec}{\mathbf d}\) \(\newcommand{\dtil}{\widetilde{\mathbf d}}\) \(\newcommand{\evec}{\mathbf e}\) \(\newcommand{\fvec}{\mathbf f}\) \(\newcommand{\nvec}{\mathbf n}\) \(\newcommand{\pvec}{\mathbf p}\) \(\newcommand{\qvec}{\mathbf q}\) \(\newcommand{\svec}{\mathbf s}\) \(\newcommand{\tvec}{\mathbf t}\) \(\newcommand{\uvec}{\mathbf u}\) \(\newcommand{\vvec}{\mathbf v}\) \(\newcommand{\wvec}{\mathbf w}\) \(\newcommand{\xvec}{\mathbf x}\) \(\newcommand{\yvec}{\mathbf y}\) \(\newcommand{\zvec}{\mathbf z}\) \(\newcommand{\rvec}{\mathbf r}\) \(\newcommand{\mvec}{\mathbf m}\) \(\newcommand{\zerovec}{\mathbf 0}\) \(\newcommand{\onevec}{\mathbf 1}\) \(\newcommand{\real}{\mathbb R}\) \(\newcommand{\twovec}[2]{\left[\begin{array}{r}#1 \\ #2 \end{array}\right]}\) \(\newcommand{\ctwovec}[2]{\left[\begin{array}{c}#1 \\ #2 \end{array}\right]}\) \(\newcommand{\threevec}[3]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \end{array}\right]}\) \(\newcommand{\cthreevec}[3]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \end{array}\right]}\) \(\newcommand{\fourvec}[4]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \\ #4 \end{array}\right]}\) \(\newcommand{\cfourvec}[4]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \\ #4 \end{array}\right]}\) \(\newcommand{\fivevec}[5]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \\ #4 \\ #5 \\ \end{array}\right]}\) \(\newcommand{\cfivevec}[5]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \\ #4 \\ #5 \\ \end{array}\right]}\) \(\newcommand{\mattwo}[4]{\left[\begin{array}{rr}#1 \amp #2 \\ #3 \amp #4 \\ \end{array}\right]}\) \(\newcommand{\laspan}[1]{\text{Span}\{#1\}}\) \(\newcommand{\bcal}{\cal B}\) \(\newcommand{\ccal}{\cal C}\) \(\newcommand{\scal}{\cal S}\) \(\newcommand{\wcal}{\cal W}\) \(\newcommand{\ecal}{\cal E}\) \(\newcommand{\coords}[2]{\left\{#1\right\}_{#2}}\) \(\newcommand{\gray}[1]{\color{gray}{#1}}\) \(\newcommand{\lgray}[1]{\color{lightgray}{#1}}\) \(\newcommand{\rank}{\operatorname{rank}}\) \(\newcommand{\row}{\text{Row}}\) \(\newcommand{\col}{\text{Col}}\) \(\renewcommand{\row}{\text{Row}}\) \(\newcommand{\nul}{\text{Nul}}\) \(\newcommand{\var}{\text{Var}}\) \(\newcommand{\corr}{\text{corr}}\) \(\newcommand{\len}[1]{\left|#1\right|}\) \(\newcommand{\bbar}{\overline{\bvec}}\) \(\newcommand{\bhat}{\widehat{\bvec}}\) \(\newcommand{\bperp}{\bvec^\perp}\) \(\newcommand{\xhat}{\widehat{\xvec}}\) \(\newcommand{\vhat}{\widehat{\vvec}}\) \(\newcommand{\uhat}{\widehat{\uvec}}\) \(\newcommand{\what}{\widehat{\wvec}}\) \(\newcommand{\Sighat}{\widehat{\Sigma}}\) \(\newcommand{\lt}{<}\) \(\newcommand{\gt}{>}\) \(\newcommand{\amp}{&}\) \(\definecolor{fillinmathshade}{gray}{0.9}\)Energy Sources

According to the Department of Energy, the state of South Carolina generates 96.8Twh (terawatt hours= 1012 watt-hours) of electrical energy a year. This accounts for only 2% of the country's electrical power. The sources of South Carolina energy production are shown in the table below.

| Source | Twh (Terawatt Hours of Energy) | Percentage of Electrical Power |

|---|---|---|

| Coal | 28.4 | 29% |

| Petroleum | 0.1 | <1% |

| Natural Gas | 14.3 | 15% |

| Nuclear | 51.1 | 53% |

| Hydroelectric | 0.5 | <1% |

| Other Renewable | 0 | <1% |

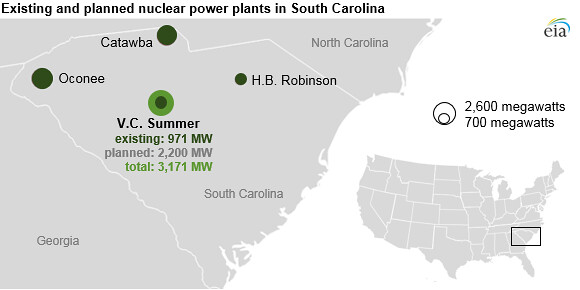

Nuclear Power in South Carolina

Oconee Nuclear Power Plant is located in Seneca, South Carolina. This facility is owned and operated by Duke Energy. The three pressurized water reactors (PWR) were constructed and then commissioned in the early 1970s. The approximate cost for the building of these three units was 1.96 billion dollars (2007). Each of the three units produces 846 megawatts (106 watts) of energy per year. In total, Oconee Nuclear Station has a maximum output capacity of 2500 megawatts of energy per year. In terms of hours, Oconee Nuclear provides 20,565 Gigawatt (109 watts) hours of power.

Like all US commercial reactors, Oconee Nuclear Station uses light water as a moderator and coolant. PWR contains 150-200 fuel rod assemblies. Both BWRs and PWR plants in the United States use low enriched uranium (LEU) embedded in each fuel rod as an energy source.

.jpg?revision=1)

For backup power, Oconee units 1-3 rely on hydroelectric sources provided by Lake Keowee. If this system were to fail, a nearby combustion facility will provide energy to cool the core uncase of emergencies.

The Fate of V.C. Summer Units 2 and 3.

The Virgil C. (VC) Summer Nuclear Station is a Nuclear Power Plant located in Jenkinsville, South Carolina, that consists of one operating unit licensed since 1982. Westinghouse Electric Company LLC (Westinghouse), a U.S.-based nuclear power company later acquired by Toshiba, designed VC Summer’s first unit as a three-loop, pressurized water reactor with a license to generate around 2,900 MWt of power for South Carolina, as seen below:

"Virgil C. Summer Nuclear Station, Unit 1" by NRCgov is licensed with CC BY-NC-ND 2.0. To view a copy of this license, visit https://creativecommons.org/licenses/by-nc-nd/2.0/ or CC BY-NC-ND 2.0.

After over 20 years of Unit 1’s success, VC Summer’s owners – SCANA Corporation, its subsidiary South Carolina Electric & Gas Company (SCE&G), and Santee Cooper – launched a massive expansion project of the plant in 2008 entailing the installment of two new reactors, Units 2 and 3. A state-owned utility company providing electricity and water to South Carolina residents since the 1930s, Santee Cooper (the South Carolina Public Service Authority) held smaller ownership in the project at around 45%, whereas SCANA, along with SCE&G, took a “majority ownership stake” of 55% and therefore handled the day-to-day operations of the project.

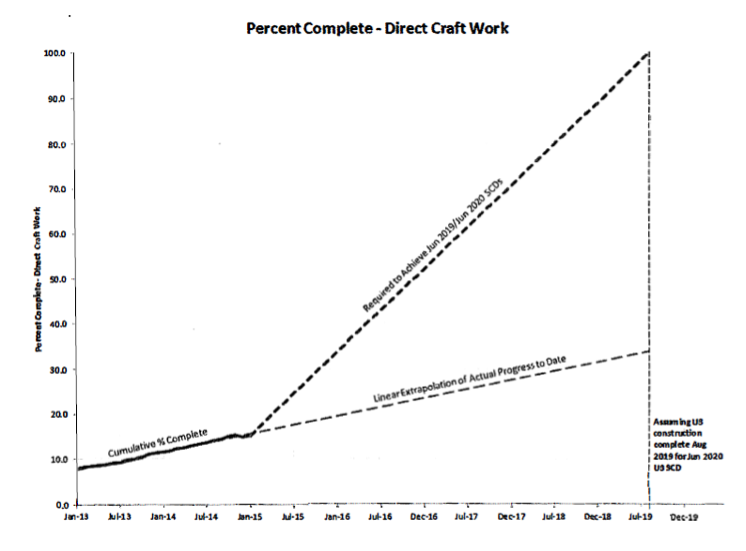

After SCANA entered an Engineering, Procurement, and Construction contract with Westinghouse and encountered a small planning delay in 2011, construction on the new units started in March 2013 and was immediately met with more delays. Despite the expected total cost of $9.8 billion dollars and completion dates of 2017 and 2018 for Units 2 and 3 respectively, SCANA announced the VC Summer expansion project would be delayed for at least one year and its units would cost an additional $1.2 billion. Upon reaching an important construction milestone on Unit 2 in installing a ‘super module’ in 2015, SCANA pushed back the completion of the reactor units back even further to 2019 and 2020.

SCANA’s repeated reassurance to the community that its partner remained committed to finishing the project in February 2017 proved futile when Westinghouse filed for Chapter 11 bankruptcy in March 2017. Without adequate financial backing to complete the nuclear units, SCANA and Santee Cooper abandoned the VC Summer project in July 2017, citing inflated costs and another delayed completion date estimated at least 2024. The failed, incomplete nuclear project not only led to Dominion Energy’s acquisition of SCANA but also resulted in a plethora of class action lawsuits by affected paying customers against the project’s company owners and the prosecution of SCANA senior executives for fraud by both the Securities and Exchange Commission and South Carolina’s U.S. Attorney’s Office, followed by expensive settlements and plea agreements, explored below.

VC Summer Legal Controversies I: Class Action Lawsuits

Due to VC Summer’s stakeholders’ heavy financial reliance on revenue from customer utility bills to fund Unit 2 and 3’s construction, both the SCANA corporation (now known as Dominion Energy) and Santee Cooper have settled several class-action lawsuits against them. A class- action lawsuit involves a plaintiff – the initiator of the lawsuit that has suffered an injury as a result of a defendant – that represents a large group of plaintiffs that have suffered the same or similar injury. Because a notable percentage of local South Carolinians’ utility bills directly contributed to construction costs, many felt they were entitled to compensation once the VC Summer project was abandoned after years of collecting funds from the public. SCANA and Santee Cooper’s extensive hold over the state drove many aggrieved customers to introduce several lawsuits, resulting in millions (and sometimes billions) of dollars in settlement agreements.

Richard Lightsey et al. v. SCE&G and SCANA, settled in the Court of Common Pleas in 2017 in Hampton County, South Carolina, resulted in the total settlement of up to two billion dollars in total for all affected SCE&G customers. A regularly updated ratepayer settlement website tracks the dates the settlement checks were released and summarizes the legal rights all SCE&G customers have in relation to the settlement; checks were mailed in August 2019.

The Cook v. Santee Cooper (2019) class action lawsuit also resulted in settlement checks for affected residents, all of whom directly or indirectly contributed to VC Summer’s unfinished Unit 2 and 3’s construction costs through utility bills. While Santee Cooper and SCE&G adamantly denied the allegation that it ‘improperly charged’ its customers in their electric bills, the company eventually agreed to settle for $520 million. SCE&G, now Dominion Energy, is required to cover $320 million of the settlement by placing the money into a Common Benefit Fund, while Santee Cooper covers the remaining $200 million in annual installment amounts beginning in 2020 of $65 million, $65 million, and $70 million, respectively. A webpage mirroring that of Lightsey v. SCANA’s settlement outlines additional specific details designed to advise all customers of their rights. Involved individuals received settlement checks in mid-November of 2020.

"Santee Cooper Bill" by TheDigitel Myrtle Beach is licensed under CC BY 2.0

SCANA Securities Litigation is a pending class-action lawsuit and settlement introduced by past SCANA investors. These groups alleged that SCANA’s senior executive team mislead them through ‘false and misleading statements,’ violating federal securities laws. They are scheduled to receive $192,500,000 from the former SCANA Corporation – $160 million in cash and $32.5 million in cash or shares of Dominion Energy common stock. While checks have yet to be released to the affected stakeholders, the SCANA Securities Litigation website states that the first distribution will occur sometime in August 2021.

VC Summer Legal Controversies II: Criminal Indictments

Recently revealed criminal activity within the SCANA Corporation further compounded VC Summer’s financial woes. On July 23, 2020, South Carolina’s U.S. Attorney General’s Office (SC USAO) announced that the former Executive Vice President of the SCANA Corporation, Stephen Byrne, had plead guilty to conspiracy to commit mail and wire fraud. The outcome of SEC v. SCANA et al, a South Carolina district court case, marked the conclusion of a joint investigation over several years by the U.S. Attorney’s Office, the FBI, the U.S. Securities and Exchange Commission (SEC), the SC USAO, and the South Carolina Law Enforcement Division (SLED). Upon entering into a plea agreement with law enforcement, Byrne was required to work with state investigators to provide information into the network of SCANA executives that continuously lied about the progress of VC Summer’s additional nuclear power stations to increase customer rates and qualify for production tax credits.

This case – referred to as a ‘conspiracy to defraud SCANA customers’ by the FBI – garnered attention from the USAO when they learned SCANA was charging its utility customers for additional commercial units that were not even built or operating yet. In SEC v. SCANA et al, the United States Securities Exchange Commission (SEC) alleged that Byrne, along with SCANA’s CEO Kevin Marsh and its senior executive team, engaged in securities fraud by intentionally and repeatedly deceiving their investors and the general public about VC Summer’s progress. Byrne carried out this fraud through issuing materially false and misleading statements as well as omissions to South Carolinians and South Carolina’s Public Service Commission and the Office of Regulatory Staff. While he privately knew that construction on the plant was far behind schedule back in June of 2016, Byrne is said to have publicly informed all involved parties that construction would be completed on time to continue increasing customer utility bills and comfortably qualify for production tax credits.

Image taken from https://www.sec.gov/litigation/compl...int-022720.pdf, the official complaint made against SCANA by the SEC on its official government website. The official litigation release can be viewed at https://www.sec.gov/litigation/litre...20/lr24976.htm.

The following year in February 2021, Kevin Marsh, the former CEO of the SCANA Corporation, also pleaded guilty to commit mail and wire fraud for his involvement in the abandoned nuclear reactor expansion project. Marsh admitted that he intentionally defrauded rate-payers in order for his company to "obtain and retain rate increases imposed on SCANA’s customers and qualify for up to $2.2 billion in tax credits,” as stated by the U.S. Attorney's Office. As CEO of a former Fortune 500 company, Marsh was charged for committing equally serious criminal offenses to that of Stephen Byrne. Furthermore, on June 10, 2021, the former Westinghouse VP Carl Dean Churchman plead guilty to making a false statement to the FBI as they were in the process of conducting the VC Summer investigation. A recent press release from the SC USAO’s office indicated that the joint investigation by law enforcement and the FBI is ongoing, potentially signaling that more indictments are coming in the next few months.

Byrne and Marsh's indictments, plea deals, and sentencing to a maximum penalty of five years in prison with massive fines serve an important lesson for corporations looking to finance nuclear power plants while simultaneously defrauding the federal government and the public – it’s just not worth it. When stakeholders deviate from the proper procedures necessary to license and fund nuclear power plants, criminal misconduct, including purposefully lying to investors and utility customers for financial gain, becomes second nature. However, if a mix of private and public governmental stakeholders follow the steps outlined in the previous section, timely, fully legal construction of commercial nuclear reactors in the United States is a real possibility, given that you have sufficient funds.

Contributors:

Andrew Allen (Furman University)

References:

- https://www.nrc.gov/info-finder/reactors/sum.html

- https://www.dominionenergy.com/projects-and-facilities/nuclear-facilities/vc-summer-power-station

- https://www.nrc.gov/reactors/new-reactors/col/summer.html

- https://www.santeecooper.com/About/Powering-South-Carolina/History/Index.aspx

- https://www.world-nuclear-news.org/NN-AP1000_construction_underway_at_Summer-1203134.html

- https://www.chooseenergy.com/news/article/failed-v-c-summer-nuclear-project-timeline/

- https://www.world-nuclear-news.org/NN-Cost-of-Summer-AP1000s-increases-0310144.html

- https://www.world-nuclear-news.org/NN-Landmark-module-installation-at-VC-Summer-2407157.html

- https://www.world-nuclear-news.org/C-Westinghouse-reassures-Summer-plant-owners-15021702.html

- https://www.world-nuclear-news.org/C-Scana-to-evaluate-Summer-options-3003177.html

- https://www.bloomberg.com/news/articles/2017-07-31/scana-to-cease-construction-of-two-reactors-in-south-carolina.

- http://www.scegratepayersettlement.com

- http://www.santeecooperclassaction.com/

- https://www.scanasecuritieslitigation.com/

- https://www.blbglaw.com/cases-investigations/scana-corporation

- Full Text of SEC v. SCANA (2020) at https://www.sec.gov/litigation/complaints/2020/comp24751.pdf

- https://www.justice.gov/usao-sc/pr/former-scana-executive-pleads-guilty-conspiracy-commit-mail-and-wire-fraud

- https://www.justice.gov/usao-sc/pr/former-scana-ceo-pleads-guilty-conspiracy-commit-mail-and-wire-fraud

- https://www.thestate.com/news/local/crime/article249477970.html

- https://www.thestate.com/news/politics-government/article247398515.html

- https://www.justice.gov/usao-sc/pr/former-scana-ceo-pleads-guilty-conspiracy-commit-mail-and-wire-fraud

- https://www.counton2.com/news/south-carolina-news/former-westinghouse-director-pleads-guilty-in-federal-court-to-making-false-statements-to-fbi-in-v-c-summer-nuclear-reactor-investigation/?utm_medium=referral&utm_campaign=socialflow&utm_source=t.co

Footnotes and Supplementary Information:

See https://www.nrc.gov/info-finder/reactors/sum.html for a statistical breakdown of Unit 1 of VC Summer. Also see https://www.dominionenergy.com/projects-and-facilities/nuclear-facilities/vc-summer-power-station for the current official website of the VC Summer Reactor.

See https://www.santeecooper.com/About/Powering-South-Carolina/History/Index.aspx for more on Santee Cooper’s history. Also see pages 11-12 of SEC v. SCANA et al. (2020) here.

See https://www.world-nuclear-news.org/NN-AP1000_construction_underway_at_Summer-1203134.html for more details on the cost of AP1000s.

See https://www.chooseenergy.com/news/article/failed-v-c-summer-nuclear-project-timeline/ for a timeline of the delays. Also see https://www.world-nuclear-news.org/NN-Cost-of-Summer-AP1000s-increases-0310144.html for more information on the 2014 delay.

See https://www.world-nuclear-news.org/NN-Landmark-module-installation-at-VC-Summer-2407157.html to read more about Westinghouse’s 2015 construction success.

See https://www.world-nuclear-news.org/C-Westinghouse-reassures-Summer-plant-owners-15021702.html for SCANA’s continued commitment to the project and https://www.world-nuclear-news.org/C-Scana-to-evaluate-Summer-options-3003177.html for its reaction to Westinghouse’s bankruptcy.

See https://www.bloomberg.com/news/articles/2017-07-31/scana-to-cease-construction-of-two-reactors-in-south-carolina for Bloomberg's coverage of the project's abrupt end.

For a brief introduction to VC Summer’s Legal Drama, see here and here for the civil settlements and here for more on the criminal aspects of the case.

Affected investors serving as plaintiffs in SCANA Securities Litigation (2021) include West Virginia Investment Management Board, Stichting Blue Sky Global Equity’s Active Low Volatility Fund, and Stichting Blue Sky Active Large Cap Equity USA Fund.